- Beauty

- 5 years ago

THE BEST-SELLING PRODUCTS ON AMAZON UNDER $40

Can you say low-key amazing?

trends12 months ago

Best chill out gifts for yoga lovers.

trends1 year ago

Say “I Love You” with these gifts

trends1 year ago

If you like Reformation, try these.

trends2 years ago

trends2 years ago

The outfit combo that never fails.

THE BEST-SELLING PRODUCTS ON AMAZON UNDER $40

Can you say low-key amazing?

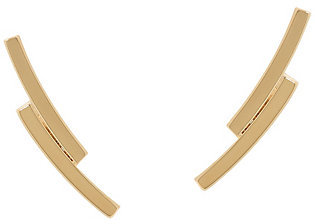

Sometimes the smallest accessories make the biggest statement. Shop our favorite ear cuffs below!

100 Ear Cuffs You Need in Your Jewelry Collection NOW

100 Ear Cuffs You Need in Your Jewelry Collection NOW

100 Ear Cuffs You Need in Your Jewelry Collection NOW

100 Ear Cuffs You Need in Your Jewelry Collection NOW

100 Ear Cuffs You Need in Your Jewelry Collection NOW

100 Ear Cuffs You Need in Your Jewelry Collection NOW

100 Ear Cuffs You Need in Your Jewelry Collection NOW

100 Ear Cuffs You Need in Your Jewelry Collection NOW

100 Ear Cuffs You Need in Your Jewelry Collection NOW

100 Ear Cuffs You Need in Your Jewelry Collection NOW

career1 year ago

Our recent experience of coming out of the relationship was not to jump again.

career2 years ago

The outfit combo that never fails.

career2 years ago

Managing your money, a financial checklist.

career3 years ago

These are highly correlated with success.

career4 years ago

Your job is to find the longest pay-back time, the lowest interest rates, and the smallest fees.

money2 years ago

Managing your money, a financial checklist.

money4 years ago

Your job is to find the longest pay-back time, the lowest interest rates, and the smallest fees.

money4 years ago

Every woman should earn what she deserves. Period.

beauty3 months ago

A Revelation in Wellness.

beauty11 months ago

Hey, baby face.

beauty1 year ago

And they won’t hurt your wallet either.

beauty1 year ago

The results are incredible.

beauty1 year ago

Say “I Love You” with these gifts

Subscribe Now.