You know those weeks when it feels like you’re just spending money every single day? We hear you — it’s kind of like that happy hour you so badly want to attend after work.

You got out early. You had a tough day and you just want to see your girls. But giving up that happy hour drink and appetizer ($15 per night out x 10 workdays a month = $150) can make a big difference at the end of the month.

Don’t get me wrong, payday is amazing. But what you do with the money you make is really what’s key.

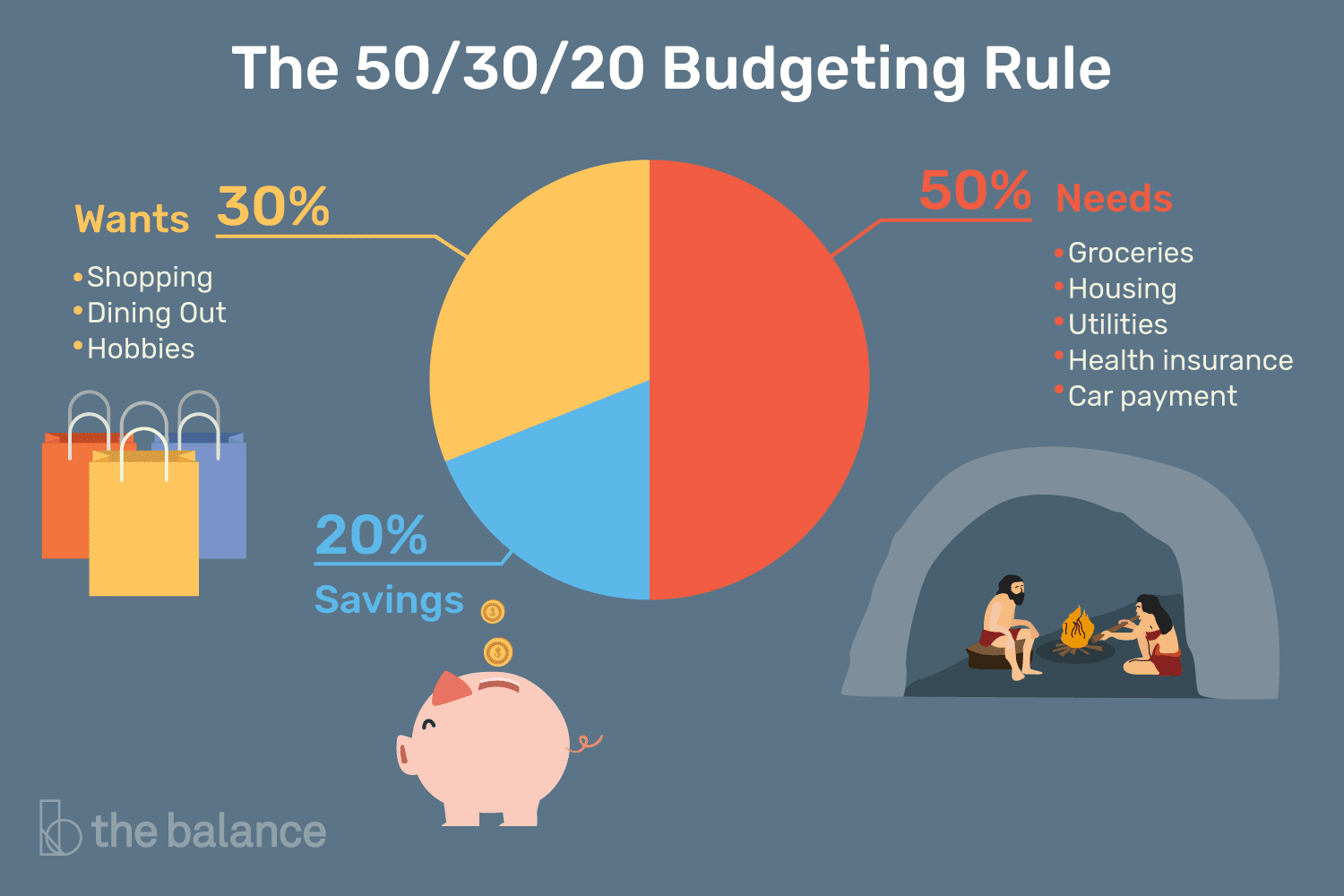

We’re all managing multiple financial goals throughout our lives, so how can we save and invest, and still enjoy the life we’re living now? One of the easiest, most effective ways to organize your finances is by using the “50/30/20 rule” for spending and saving. Senator Elizabeth Warren created the 50/30/20/rule for spending and saving when co-authoring a personal finance book with her daughter, Amelia Warren Tyagi: All Your Worth: The Ultimate Lifetime Money Plan.

So how does the 50/30/20 plan work?

The rule is a simple, accessible way to understanding how to best spend and save your money.

By organizing your expenses into three main spending categories, the 50/30/20 rule can help you budget, while helping you get closer to reaching your financial goals.

Keep reading to learn the simple four step guide you need to start using the 50/20/rule in your own life.

Step One: Calculate Your After-Tax Income

Step One: Calculate Your After-Tax Income

You’re going to make it a habit to budget a little each month, but how much exactly? “The best way is to take out your monthly bank statements and divide your after-tax income among needs, wants, savings and debt repayment,” says Sallie Krawcheck, CEO, and co-founder of Ellevest, a digital financial advisory for women. Your after-tax income is what remains of your paycheck after taxes are taken out, for example, local tax, state tax, income tax, Medicare, and Social Security.

If you have a steady paycheck, your after-tax income should be easy to find out. Simply, look at your paystubs. And if retirement contributions, or any other deductions are taken out of your paycheck, add them back in.

If you’re self-employed, your after-tax income equals your gross income less your business expenses, for example the cost of your laptop or office supplies or airfare, as well as the amount you set aside for taxes. If you’re self-employed, you’re responsible for remitting your own quarterly estimated tax payments to the government because you don’t have an employer to take care of it for you.

In a planning mood? See how an investment plan could help you manage your finances. Ellevest is one way to do it. You can get a personalized portfolio in under 10 min. And it’s made by women, for women.

⇒ Get Started Investing With Ellevest

Step Two: Cap Your Needs to 50 Percent of Your After-Tax Income

Congratulations! Now that you’ve figured out your monthly after-tax income, think about your monthly financial responsibilities. How much do you spend on “needs” each month, such as like groceries, housing, utilities, health insurance, car payment, and car insurance? According to Warren and Tyagi and their 50/30/20 rule, the amount that you spend on these things should be at 50 percent of your after-tax income.

Of course, it’s not easy to know what true “needs”are. Basically, think of this as thing you can’t live without. For instance, if you don’t pay your car you’ll probably run into troubles, so that would be considered a need. You also need to pay rent, eat, and you probably can’t live electricity. In other words, any payment that you can’t forgo paying can be considered a “need,” according to the Warren and Tyagi.

Step Three: Limit Your “Wants” to 30 Percent

Easier said than done, but you can do it. Can you put 30 percent of your money toward your wants? This is everything you buy that you want but don’t necessarily need think new rooftop cocktails, Netflix accounts, a trip to Tulum, salon haircuts, and sushi restaurants.

Wants are the basic niceties of life that you enjoy. You may be spending more on “wants” than you think. For example, if it’s summer, you may need a bathing suit, but you don’t need a department store bathing suit, if you can get one at a discount stores. Thinking about what your needs are is a great opportunity to reflect on the expenses in your life. This way, you’ll know what you’re spending on versus what you should actually be spending.

Yes, the rules are tricky to master for your own life, but if you think about it, they make sense. Bottom line: It can be fun spending money. It can be even more fun watching your savings grow.

Ellevest is an easy online investing tool using algorithms tailored to your salary, gender, and lifespan (aka your real life).

⇒ Get Started Investing With Ellevest

Step Four: Spend 20 Percent on Savings, Debt Repayments and Investing

Almost there… so now you’ve accounted for the first 80% of your income — with 50% going to needs and 30% to wants. What’s left is 20%. This last portion should be set aside for savings, additional debt repayments, and investing, depending on your circumstances.

First, focus on saving money in an emergency fund, then put money towards your retirement and paying down debt (including student loans, balance transfers, or car loans). Do you have all of those things under control? Now, you can start saving this money toward other future goals like starting a business, buying a home, or just investing in Future You!

While 20% may seem small compared to the others, if you’re using it wisely, then this amount can add up quickly thanks to the power of compounding returns on your investments.

Ready to start investing in your goals?

Our friends at Ellevest know a lot about how to handle that cash money. Their digital service uses an algorithm specifically designed for women’s incomes and life cycles to figure out the best investing strategy for you.

The platform is well-designed, easy-to-use, and speaks to our unique financial needs — whether that be planning for retirement, that Aussie vacation, or starting a family. The best part? The advisors at Ellevest are incredibly knowledgeable and will help you every step of the way. Another big bonus? Ellevest has no minimum so you can start with as little as $5 today. Plus Style Salute readers get a little something extra to start you off. Learn more here.

⇒ Get Started Investing With Ellevest

An Example of the 50/30/20 Plan

Let’s say your total take-home pay each month is $3,000. Using the 50-30-20 rule, you have a $1,500 limit to spend on your needs per month. This means your rent needs to be well under $1200. This is unless your car payment, utilities, credit card payments, insurance premiums, and other necessities of life don’t exceed $300 a month.

If you’re in a situation where you pay more for rent (own your home or locked into a lease), what you can do to change that? Relocating is one option. You can also take another look at your “needs” to see if there’s a way that you can reduce anything these. Maybe shop for more affordable car insurance or transfer the balance on that credit card to one with a lower interest rate so your minimum payment drops.

Ultimately, you goal is to be able to fit all these expenses into 50 percent of your take-home after-tax income.

You can spend $900 a month on your “wants” based on that $3,000. If you’re over budget here, take a step back and look at your life, look at your choices. Stop to think about the recurring costs that and whether there are cheaper alternatives that could work for you. Anything from your car payment, housing situation, and making coffee instead of buying it. By changing up your daily habits, you could save hundreds of dollars a month. That’s a fact.

Remember, you still need 20 percent left over so you can save. pay down your debts, and invest towards Future You. Now you have $600 left, that last 20 percent. You know what to do with it. Pay down on debt, save for an emergency, and plan for your future.

What If I Have No Self-Control?

Put yourself on autopilot.

Automation is the easiest way to save. When you choose to invest — whether it’s a dollar amount or a percentage of your pay — the money goes into your account before it’s taxed and before you even get a chance to think about spending it. You can replicate that process for an IRA or other investment account by setting up automatic monthly payments through your bank. Doing this removes the temptation of spending instead of saving.

So yeah, retirement may seem a far way off — but there was a time when the age you are now was also unthinkable.

⇒ Get Started Investing With Ellevest

For when you don’t have an investment account …

Don’t sound the alarm – yet. You can set one up with no minimum balance here.*

Here are more money topics for you…

Answered: 401(k) vs. IRA? Use Both If You Can

The One Money-Habit All Wildly Successful Women Share

How to Increase Your Chances of a Long, Healthy (and Wealthy!) Life

Disclosures: We’re excited to be working with Ellevest to start this conversation about women and money. We receive compensation if you become an Ellevest client.